The letter should outline all services that are included in the scope of work. Services included in the scope of work should be well-defined in as thorough of terms as possible. If you enter into a relationship (professional or otherwise) with mismatched expectations between you and the other party, it’s a recipe for disaster. That’s why an engagement letter is a crucial piece of any new bookkeeping project.

By understanding the legal implications of your bookkeeping engagement letter, you can create a document that protects both parties. Once signed by both parties, an engagement letter becomes a legally enforceable contract. This means both parties are bound by the terms and conditions outlined in the document. A court can be used to enforce the agreement if there’s a breach of contract. We’ve created a sample accounting engagement letter template below, which you can use as a starting point.

How a Bookkeeping Engagement Letter will help your firm

Access hundreds of free accounting and bookkeeping process workflow templates. You can also add what will happen if the client requests extra services outside the scope of the current engagement. This may stem from miscommunications or the client’s unreasonable expectations. Engagement letters should be used by any accountant performing client work to protect themselves and establish a good business relationship based on transparency. With our e-signature features, you can easily send your engagement letter to your clients and get them signed electronically in a matter of minutes.

- If not, you need to clearly state the engagement is limited to the preparation of a tax return and any additional support needed is outside the scope of the initial engagement.

- Engagement TerminationThis agreement may be terminated by either party with number days’ written notice.

- Include information on the client’s business structure, too – sole proprietorship, partnership, LLC, corporation, etc.

- By signing below, you acknowledge that you have read, understand, and agree to the terms outlined in this engagement letter.

- All weekly bookkeeping services will be completed by Wednesday each week unless there is a holiday, in which case all services will be completed by Thursday.

I’m an entrepreneurial CPA that founded Xen Accounting, a100% cloud-based accounting firm, in 2013. Following its acquisition in 2018,I started Future Firm to help accountants fast-track the growth of a modern, scalable accounting firm of their own. Another difference between reserve and provision important aspect you must consider is how you’ll send the engagement letter to your clients. For full details of each service, please refer to the Service Terms section below. Here is a comprehensive list of the top free templates every accounting firm should have.

Before you provide any services, you and your client must agree on the terms of your engagement. The bookkeeping engagement letter will clarify the responsibilities of each party, set clear expectations, and make sure you’re protected if things don’t go to plan. A clear, explicit engagement letter is your first line of defense when it comes to avoiding legal trouble. An engagement letter is not a binding agreement like a contract, but it’s a written paper that states your terms and conditions and eliminates confusion. An engagement letter is a good safeguard to help you avoid confusion, anger, and ultimately, a lawsuit. An accounting engagement letter template like ours will help you make sure that you have all the bases covered so you can avoid unpleasant situations in the future.

Terms and conditions

Make sure to specify your expectations around meeting deadlines for reports and deliverables. While we stand behind our professional judgment and experience, our services are governed by the professional standards of the AICPA. The annual review will be completed within 6 weeks of receiving your financial information.

Bookkeeping Engagement Letter Guide and Templates for Small Business Owners

This guarantees both a mutual legal understanding and agreement of the listed terms and conditions. The document also outlines the engagement period and the process for termination by either party. If you don’t know how long you’ll need bookkeeping services for, you can list it as an ongoing engagement.

For example, reasons for termination can include non-payment, breach of contract, or dissatisfaction with services. Outline the process of termination, too, and include any conditions, such as providing 30 days’ written notice. Accounting engagement letters should include terms which limit the firm’s liability as much as possible. In addition, it’s wise to include resolution terms such as requiring use of mediation to resolve any future disputes with the client.

What is An Accounting Engagement Letter?

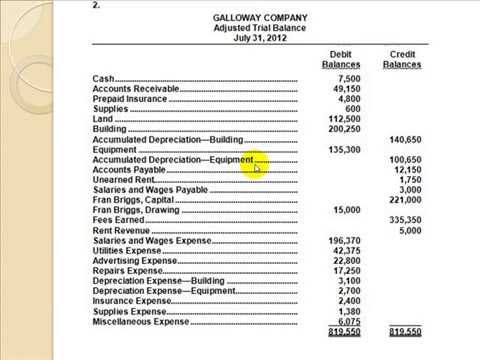

For example, does your engagement include follow up calls to the IRS, audit support, or document storage? If not, you need to clearly state the engagement is limited to the preparation of a tax return and any additional support needed is outside the scope of the initial engagement. If you’re reading when do intangible assets appear on the balance sheet this far, you likely have an idea about what each component of the contents of engagement letters, as a legally binding document, usually have. Does your firm use an accounting engagement letter when signing on a new client? Download free accounting templates to manage everything from client onboarding to payroll processing.

When you’re done drafting the letter, proofread it thoroughly before signing it. This section can specify what information you consider as confidential. It should also define any limitations you how to prepare a post closing trial balance have for how the bookkeeper can use or disclose this information.