Intuit provides patches, and regularly upgrades the software automatically, but also includes pop-up ads within the application for additional paid services. While setting up QuickBooks, you can connect your bank as well as credit card accounts to the software. Once done, QuickBooks tracks your bills and expenses automatically.

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. By far, the largest headache in preparing a tax return is compiling your income and expenses. If you use QuickBooks during the year, all you need to do at tax time is print your financial statements.

Learn QuickBooks Online

For example, you can manage both your cash inflow and outflow activities. You can also print out financial statements to get a visual of your company’s financial health at a glance. The Ascent is a Motley Fool service that rates and reviews essential products how to understand the forex spread for your everyday money matters. As a small business owner, it’s likely that invoicing will be the most important feature you’ll use in QuickBooks Online. No need to worry if you skip one; you can go back and add others later. Our QuickBooks Online introduction can help, guiding you through some of the common features found in the software as well as providing easy, step-by-step instructions for using those features.

The payroll add-on calculates payroll automatically as often as you want. Three plans give your business the scalability to grow over time and add features as necessary. The Core plan offers everything a small to midsized business would need to get started, while Premium and Elite plans enable options such as same-day direct deposit and expert assistance with setup. QuickBooks provides small businesses and entrepreneurs key financial management capabilities to run operations efficiently.

In summary, QuickBooks provides small businesses with tools to manage key financial processes. This tutorial covered getting started with QuickBooks as well as using features like invoicing, expense tracking, reporting, and more. Integrations further extend capabilities to meet specific business needs. You’ll get acquainted with the QuickBooks interface, essential functions like invoicing and expense tracking, multi-currency support, payroll, reporting, and analytics.

- As with time, these billable expenses will be available to add to the customer’s next invoice.

- Integrations avoid duplicate data entry and give deeper business insights by centralizing information in one platform.

- If you want, you can also invite them to view the reports themselves and download whatever they need.

- QuickBooks makes it easier for your business as it calculates your income and expenses automatically as they happen.

- QuickBooks for Mac is a version of the accounting software designed for Mac users.

However, access to add-on services to the QuickBooks Desktop for Windows 2019 was discontinued after May 31, 2022. QuickBooks makes it easier for your business as it calculates your income and expenses automatically as they happen. As you accept bookkeeping terms payment for any item in the inventory, the right expense account is updated and reflected automatically in taxable income.

What Does QuickBooks Do in Terms of Bookkeeping?

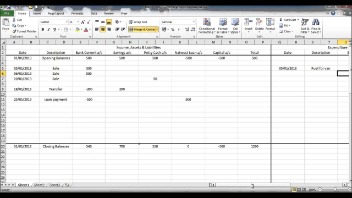

QuickBooks is the most popular small business accounting software suite. It comes in a variety of editions and has web-based and desktop programs. QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes. QuickBooks is the most popular accounting software suite widely used by small businesses to manage their financial transactions. It lets you invoice customers, pay bills, generate reports, and print reports to be used to prepare taxes. QuickBooks allows users to create income and expense accounts to track all money flowing in and out of the business.

What do accountants think of QuickBooks Online?

As a business owner, you know how important it is to manage a regular positive cash flow. QuickBooks Payments makes it easier for you to accept online payments when you send invoices from within the app. QuickBooks allows you to enter new bills and expenses and keep track of them automatically by connecting your bank and credit card accounts to the platform. By doing so, all your expenses are downloaded and categorized automatically. This informs data-driven decisions about product/service pricing, customer acquisition, inventory direct vs indirect cash flow planning, cash flow management, and more to improve financial performance.

You can then share the invoice with clients through the mail or take a printout and send a hard copy. It allows you to run and view reports easily like the number of outstanding invoices, total amount due from clients and details of each invoice (paid or due). Our team of experts are here to support you 24 hours a day, Monday to Friday. Get real time help via live chat where you’ll get an instant reply from our support team. QuickBooks uses advanced, industry-recognised security safeguards to keep all your financial data protected. Organise your finances in one secure, automatically backed up place and work anytime from any device.